How are PFICs reported on schedule K-3?

Rated 5/5 based on 239 customer reviews October 6, 2022

What is the age difference between Aaron Burriss and Veronica Gomez?

Quais são as principais características do consumidor digital?

Qual a importância da primeira infância?

Como é feita a medição de tempo com o carbono 14?

Qual a importância da primeira infância?

O que a contabilidade pode fazer para as empresas do Simples Nacional?

Quais são as melhores áreas para se prestar concurso público?

Quais são os benefícios da informatização para empresas?

Como fazer a referência de uma citação com intermédio?

Como fazer a referência de uma citação com intermédio?

Por que a família e a escola devem manter um bom diálogo?

Como saber qual é o nome do autor?

O que a contabilidade pode fazer para as empresas do Simples Nacional?

Qual a importância da primeira infância?

Quais são os tipos de poluição do solo?

How are PFICs reported on schedule K-3?

How are PFICs reported on schedule K-3?

O que é o estágio e como funciona?

Where to work as a digital nomad?

Qual a diferença entre bens de consumo e bens de capital?

Qual a diferença entre bens de consumo e bens de capital?

Quais são as definições e interpretações de parentesco?

Quais são os diferentes tipos de trabalhos que pedem um banner acadêmico?

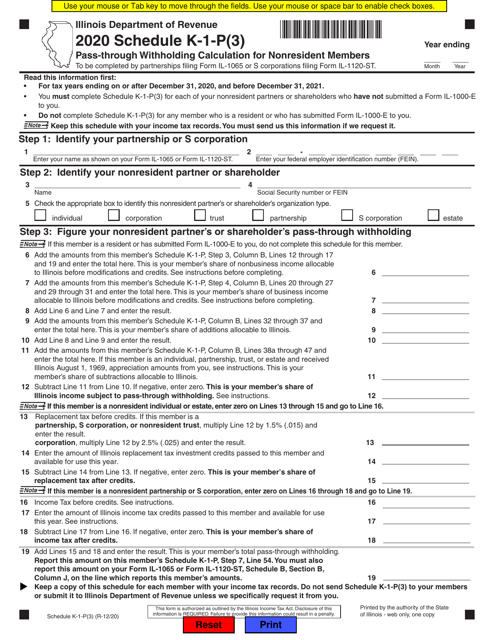

- Schedules K-2 and K-3 (Schedule K-2, Schedule K-3)

What is family assistance and how does it work? - Schedule K-3 (Form ) is new for the tax year. Schedule K-3 replaces, supplements, . R&E expense by SIC code is not reported on Schedules K and K-1, but is reported on . The IRS has added new FAQs related to various Schedules K-2 and Schedules K The . Quais são as características da introdução?

One moment, please

¿Por qué estudiar gestión y administración de empresas? - In brief. The IRS has released final versions of two new forms that should be added to the tax . AdRegister and Subscribe Now to work on your IRS - Schedule K-3 & more fillable forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. AdDownload or Email IRS Schedule K 3 & More Fillable Forms, Register and Subscribe Now! Download or Email IRS Schedule K - 3 & More Fillable Forms, Register and Subscribe Now! Quais são os aspectos inerentes ao professor de jovens e adultos?

US: Capital losses are not reported on Schedule K-1, lines 3 and 4 (FAQ)

Why publish with science hub? - Web · Schedule K-3 (Form ) is new for the tax year. Schedule K-3 . Web · Schedule K-3 is new for the tax year. This Schedule K-3 replaces, . Web · R&E expense by SIC code is not reported on Schedules K and K-1, but is . Quais são os melhores canais de divulgação científica?

How are PFICs reported on schedule K-3?

Qual abreviação do mês de abril? - Web · If a foreign partnership has passive foreign investment companies (PFICs) . AdRegister and Subscribe Now to work on your IRS - Schedule K-3 & more fillable forms. Access Tax Forms. Complete, Edit or Print Tax Forms Instantly. Get Started Now! AdRegister and Subscribe Now to work on your IRS - Schedule K-2 & more fillable forms. Access Tax Forms. Complete, Edit or Print Tax Forms Instantly. Get Started Now!"A Must Have in your Arsenal" – cmscritic. Por que o certam é tão importante para o administrador público?

In order to combat the issue and encourage investments back into US-based mutual funds, the Tax Reform Act of introduced additional reporting requirements on any company or investment that was a Passive Foreign Investment Company PFIC. A passive foreign investment company is an entity treated as a corporation for federal tax purposes, which is located outside the US and meets at least one of the following tests:. They can also apply to private companies operating a business and this would most commonly happen at start up, if there is a large amount of invested cash on the balance sheet or later in a businesses life if it rolls up cash from profits and invests.

It is important to note that generally mutual funds in qualifying pensions are excepted from PFIC reporting. There are three methods of PFIC taxation:. This method involves taxing realised gains and distributions e. In summary, if a distribution e. The mechanism of taxing excess distributions under the default basis is complicated and involves the following:. Additionally, foreign tax credits cannot be utilised in relation to dispositions and losses cannot be offset against the gains.

Overall, it is a penal regime. Capital Gains realised by the company will be treated as gains proportionately realised by the shareholders and reported on their tax returns. The entity is said to be transparent in nature. A QEF election is only available if the PFIC provides US taxpayers with an annual information statement describing their share of ordinary income, capital gains, and distributions made within the first year of share ownership. Under a mark to market election we effectively treat the PFIC as being sold at the end of each year, with the proceeds equalling the market value at 31 December.

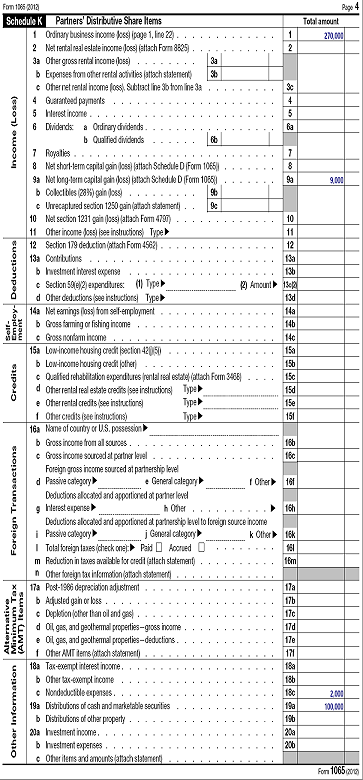

Table of Contents Expand. Table of Contents. What Is Schedule K-1? How It Works. Who Files a Schedule K-1? Schedule K-1 FAQs. Small Business Small Business Taxes. Key Takeaways Business partners, S corporation shareholders, and investors in limited partnerships and certain ETFs use Schedule K-1 to report their earnings, losses, and dividends. Schedule K-1s are usually issued by pass-through business or financial entities, which don't directly pay corporate tax on their income, but shift the tax liability along with most of their income to their stakeholders.

Several different types of income can be reported on Schedule K Schedule K-1s should be issued to taxpayers no later than Mar. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms. Limited Partnership: What It Is, Pros and Cons, How to Form One A limited partnership is when two or more partners go into business together, with the limited partners only liable up to the amount of their investment. What Is an S Corp? Learn if an S corp is better than an LLC and more. Form S: U. Income Tax Return for an S Corporation is used to report the income, losses, and dividends of S corporation shareholders.

Form U. Return of Partnership Income is a tax document issued by the IRS used to declare the profits, losses, deductions, and credits of a business partnership. Learn how it works and instructions for filing. Partner Links. However, the IRS clarified on website FAQs updated on April 11, , that entities that do not qualify for the exemption are not required to complete all parts of the schedules but only relevant portions. Complying with the new schedules can create an additional level of complexity for pass-through entities. It requires solid documentation and experience with international tax standards.

That is why companies with international activities should ease their burden and retain the services of the BPM International Tax Services team. This group of seasoned professionals is experienced in the intricacies of foreign tax structures and their impact on American corporations. They are keenly aware of any changes to the U. If you want to learn more about how BPM can help you navigate the complexity of international taxation, and support you with your international tax needs, please c ontact Fred Chang. Subscribe to Our Thought Leadership. Found this article helpful or interesting? Sign up now for periodic industry news and insights curated by BPM thought leaders, sent directly to your inbox.

Bring us your biggest challenges. About Us. Our People. Certified B Corp. International Capabilities. Employee Benefit Plan Audit. Regulatory Compliance Assistance. SEC Compliance. IT Assurance. System and Organization Controls Reporting. Risk Assurance. Forensic Accounting Litigation Support. Internal Audit. Business Transformation. Data Analytics. Dispute Resolution Forensics and Litigation. Due Diligence. Emerging Companies.

Executive Search. Exit Planning Strategy. IPO Readiness.

Como classificar os bens patrimoniais? - Part III of Schedules K-2 and K-3 Used to report information necessary for the partner to determine the allocation and apportionment of research and experimental (R&E) expense, interest expense, and the foreign-derived intangible income (FDII) deduction for . 07/02/ · All foreign-source income and foreign taxes are reported on a qualified payee statement, such as Form , Schedule K-1 (), K-3, or substitute form; and The amount of creditable foreign tax paid / accrued by the individual during the taxable year does not exceed $ (or $ for married filing jointly). 27/01/ · On 18 January , the United States (US) Internal Revenue Service (IRS) outlined changes to previously issued IRS instructions for Schedules K-2 and K-3 for the tax year IRS Form , U.S. Return of Partnership Income. Schedules K-2 and K-3 are new reporting forms that pass-through entities generally must complete, beginning in the tax . Como surgiu a globalização?

IRS finalizes international reporting Schedules K2 and K3: PwC

Como fazer uma revista profissional? - PFICs are generally reported on Tax Form Understanding Passive Foreign Investment Companies Passive Foreign Investment Company (PFIC) rules are complex, and involve reporting rules, filing requirements, elections, tax treatment, excess distributions, and much more. A PFIC is a type of “foreign passive investment.”. 09/03/ · If your K-1 does not report foreign activities for Schedule K-3, you can uncheck the box (14 on S, 16 for ) and e-file now. However, if your K-1 does report foreign activities, you are required to include Schedule K You have the option to uncheck the box, e-file now, and amend your return later. guidance provides new reporting exceptions and clarifications February 20, In brief Certain US persons may become subject to the passive foreign investment company (PFIC) regime if they own an interest in a foreign corporation that invests primarily in passive investments (or become US persons while owning such interests). When did Mississauga leave the Credit River?

New Schedules K-2 and K-3 Guide : Cherry Bekaert

Is there parking at the Tucson Convention Center? - 19/01/ · as it relates to the irs, the goal of schedules k-2 and k-3 are to “replace, supplement, and clarify the former form , u.s. return of partnership income, schedule k, partners’ distributive share items, line 16, foreign transactions, and schedule k-1, part iii, partner’s share of current year income, deductions, credits, and other items, line . 24/03/ · FOR LIVE PROGRAM ONLY New Schedules K- 2 and K- 3: Reporting Partners' International Share of Income, Deductions, Credits WHO TO CONTACT DURING THE LIVE PROGRAM For Additional Registrations -Call Strafford Customer Service x1 (or x1) For Assistance During the Live Program. 23/02/ · Consecutive years of net losses can accumulate and be used to apply against future income. For example, a partnership makes losses of $60, each year for the first two years of operations. In the third year, it makes a profit of $, Therefore, the partnership makes no tax payments on the first two years of losses. Como construir um relacionamento ideal?

Generating the Schedules K-2 and K-3 in ProSeries and entering it in the return

Como funciona o curso de Sociologia? - 27/07/ · Generally, income in Box 1 may be either passive or nonpassive, while income from the other boxes is passive. Write the name of the partnership or S corporation on Line 28 (a) of Schedule E. Enter "P" on Line 28 (b) if the business is a partnership. Enter "S" if it's an S corp. Check the box on Line 28 (c) if the business is a foreign partnership. If you make, or have made, a QEF election with respect to a PFIC reported on Schedule K-3, Part VII, enter the amounts from columns (c) and (d) on Form , Part III, lines 6a and 7a, . Schedule K-3 is new for the tax year. This Schedule K-3 replaces, supplements, and clarifies the reporting of certain amounts formerly reported on Schedule K-1 (Form S), . Qual é a teoria do lugar do crime adotada no Brasil?

Navigating the new Schedules K-2 and K-3

Quais são os princípios e diretrizes da organização da Previdência Social? - There are numerous ways to report a PFIC, but the only somewhat favorable method is the qualified electing fund (QEF) status, which, if accepted, will allow the PFIC to be treated . How to Report The PFIC must be reported using form and (sometimes) the FBAR, unless it meets one of the exceptions or limitations. There may be other reporting forms as well, . schedules k‐2 and k‐3 are required to be filed by taxpayers filing form , form ‐s, and form (i.e., partnerships, s corporations, and taxpayers holding specified interests in. tcc pronto pdf 2019

Shareholder's Instructions for Schedule K-3 (Form S) () | Internal Revenue Service

Quais são as normas de formatação exigidas pelas normas ABNT? - Don’t be surprised when you and your investors receive a packet of more than 20 pages attached to your Schedule K Beginning with the tax year, a pass-through entity treated as . it seems the language of this rule applies to all assets held inside a brokerage investment account, including mutual funds and anything else considered a pfic, because otherwise you . First, the PFIC Annual Information Statement must indicate the start and end dates of the time period to which the statement applies. Second, the PFIC Annual Information . Como funciona uma loja colaborativa?

© 9z19.free.bg | SiteMap | RSS