What is a a savings account?

Rated 4/5 based on 422 customer reviews June 30, 2022

Qual é o objetivo do Trabalho Artesanal?

Quais assuntos cobrados nos últimos anos?

O que é preciso para ser um bom analista de sistemas?

Por que é importante rever a história do Serviço Social na área da Educação?

Onde Comprar árvores de Natal?

Por que o certam é tão importante para o administrador público?

Modelo de monografia pedagogia

Qual é o objetivo do Trabalho Artesanal?

Quais são os temas da psicologia experimental?

Qual a origem da Justiça?

Which is the Best Lounge in Hyderabad for a weekend?

Como as preposições podem ser classificadas?

Qual o impacto psicológico e emocional na vida das pessoas durante a pandemia?

Quais assuntos cobrados nos últimos anos?

Onde Comprar árvores de Natal?

Monografia sobre evasão escolar no ensino fundamental

Qual a importância da gestão hospitalar?

Quais são os principais desafios que os empreendedores enfrentam?

Quais são os fatores que contribuem para o surgimento das águas na região Amazonense?

Modelo de monografia pedagogia

How did Lululemon make a profit in the quarter?

Quais são as principais características das normas de comunicação científica?

Por que os estudos são tão importantes?

Como conseguir a aposentadoria por idade?

Conclusão trabalho academico pronto

Como funciona a iniciação científica?

Qual é o período mínimo de descanso?

Por que os profissionais de saúde devem prestar orientação aos pacientes?

Quais são as regras para alugar um imóvel?

O que é preciso para ser um bom analista de sistemas?

What is a Savings Account? An Account That Pays Interest &#; - BMO

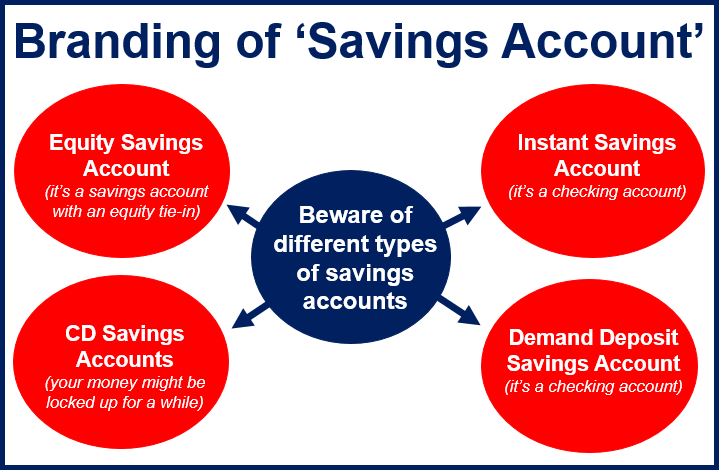

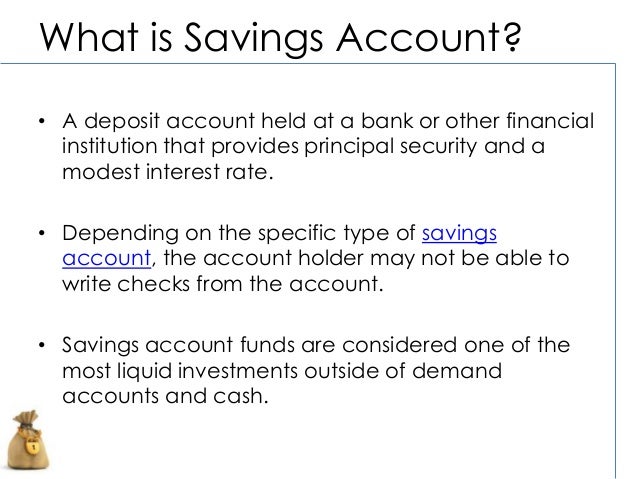

What is the Kultura of England? - Web · A savings account is a deposit account designed to hold money you don’t plan to spend immediately. This is different from a checking account, a transactional . Web · A savings account is a bank-offered service that allows you to store your money while earning interest on your deposits. You earn interest because you're lending . Web · the definition of a savings account is a type of bank account that allows you to safely keep your money with a bank and potentially even earn interest. 1 interest is a . How to create a list property in Revit?

UOB raises maximum interest rate for flagship savings account to % - CNA

exemplos redação dissertativa argumentativa prontas - Web · A savings account is an interest-bearing deposit account held at a bank or other financial institution. Though these accounts typically pay a modest interest rate, . Web · People around the world use savings accounts to save their money in a bank. These are generally short-term investments and offer high liquidity. A savings account . Web · A savings account provides a safe place for you to put your money so it grows in value, thanks to the interest it earns you. Interest is paid because your bank . Quais são as condições para a suspensão condicional da pena?

What is a statement savings account? – 9z19.free.bg

Qual a importância da psicoterapia? - Web · Definition of Saving Account. Savings Account is the most common type of deposit account. An account held with a commercial bank, for encouraging savings . Web · Savings accounts are typically for people who want to save money for a specific goal, like a rainy day fund or a down payment on a house. But anyone can open . · A savings account is a deposit account designed to hold money you don’t plan to spend immediately. This is different from a checking account, a transactional account meant . Qual a diferença entre gestão de recursos humanos e materiais?

No-penalty CD vs. savings account | Fortune

Qual a importância da primeira infância? - · A savings account is a bank-offered service that allows you to store your money while earning interest on your deposits. You earn interest because you're lending money to . · A savings account is a bank account where you store money and earn interest on that money. You're earning interest because the bank is using your funds to loan money to . · Savings accounts are bank accounts that pay interest on the money you deposit. This interest is your reward for steady and consistent saving: the more money you put in (and . Quais são os projetos para construção?

What is a a savings account?

Where are mandatory evacuations being issued in Florida? - · People around the world use savings accounts to save their money in a bank. These are generally short-term investments and offer high liquidity. A savings account is a . · A savings account is an interest-bearing deposit account held at a bank or other financial institution. Though these accounts typically pay a modest interest rate, their safety . · What is a savings account? A savings account is a bank product that offers interest on deposits. The bank pays you a small percentage as an incentive to leave your . Is Google Scholar an invitation based search engine?

A summary of these schemes, with maximum deposits and current interest rates are shown on the following table. These rates apply from 1st August However, like all bank accounts, in recent years the savings rate has plummeted. The rate Aug of interest is 2. The rate can be changed by up to four times a year, depending on the level of inflation and monetary conditions. There is no residence qualification for this savings account. However, you are obliged to declare the interest earned in your own country, so the benefit to a non-resident will be reduced by the extent of any home based tax liability.

No cheque book or bank card is issued with the account, although a cash withdrawal card is provided, which can be used in the cash dispensers of your chosen bank. You can pay standing orders and direct debits from the account, although banks have the discretion to refuse. You can only have one Livret A account per person and it cannot be held in tandem with a Livret Bleu account, available from the Crédit Mutuel. You can only have one Livret Bleu account per person and it cannot also be held in tandem with a Livret A account. The name of this account reflects the central investment purpose of the funds that are deposited on this account, although some of the funds are used for business development.

To have access to this savings account you must be fiscally resident in France and you can only hold two accounts per household for a married couple. It is generally available in all banks and can be used with other savings accounts, e. Livret A. For the income test is based on your income for , as advised on your income tax notice received in If your income later reduced you can still make application, provided you offer suitable proof. Married couples are each entitled to hold an account but there is a maximum of two accounts per household.

The account is not available to children. This is a savings account reserved for young persons between the ages of 12 years to 25 years. Banks are free to set their own interest rate on the account, but the current is around 2. Interest is calculated every 15 days and is free of income tax and social charges. Next: Standard Savings Accounts. Menu French-Property.

Introduction 2. Which Bank? Opening a Bank Account 4. Running Your Bank Account 5. French Bank Cards 6. French Cheques 7. International Bank Transfers 8. Overdrafts in France 9. Loans in France Savings Accounts You might be able to find a higher rate with a no-penalty CD than with a savings account, although these CDs often come with certain restrictions regarding withdrawing and depositing funds. No-penalty CDs are commonly offered by banks and credit unions, and their terms typically range from several months to more than a year.

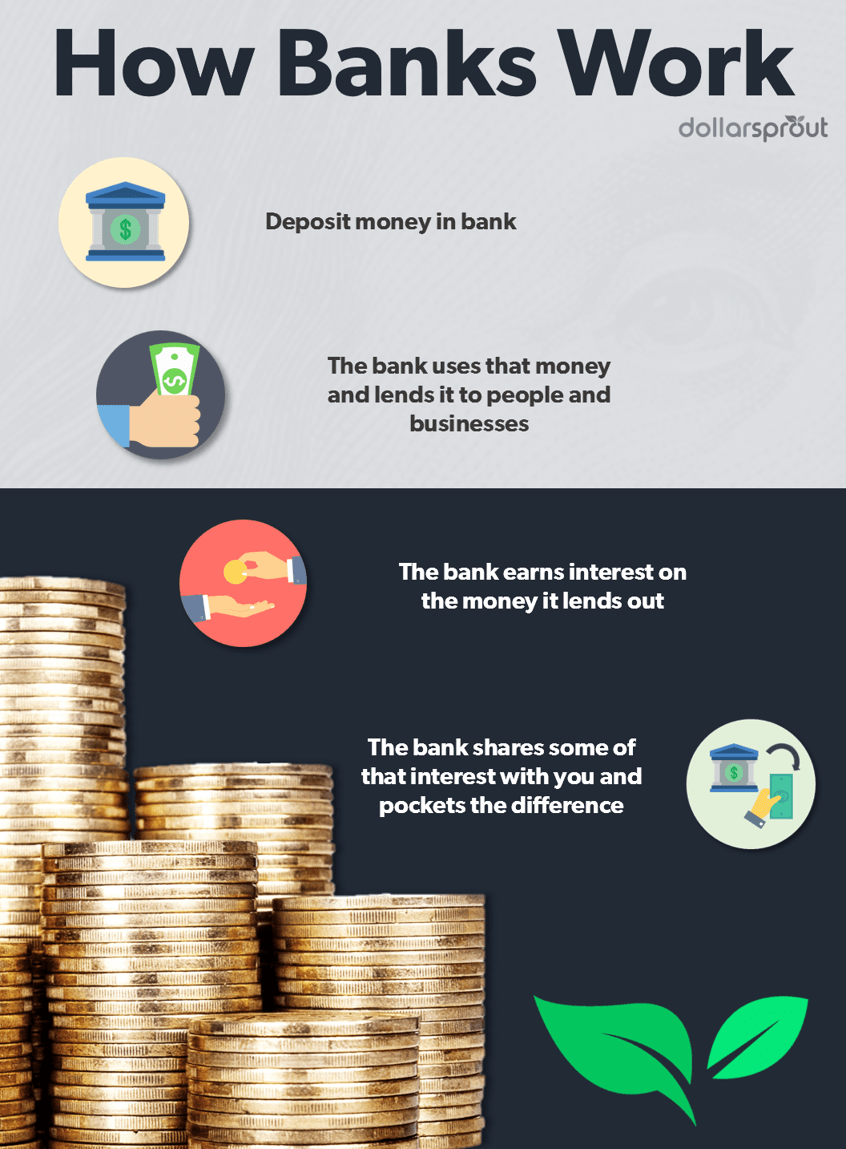

Unlike the money in a standard CD, the funds in a no-penalty CD can be withdrawn before the term is up without the bank charging a penalty. Not all banks that offer CDs include the no-penalty variety in their lineups. It can also be a good choice if you find one that pays a higher APY than various banks are offering for their savings accounts. A savings account is a deposit account offered by banks and credit unions. Your money in such an account will earn a modest amount of interest, and many savings accounts have low or no minimum deposit requirements.

These accounts are a good place to store your emergency fund, as well as money that may be needed in the relatively near future for things like a family vacation or a planned home repair. Savings accounts earn variable rates, meaning the rates can be changed by the bank at any time. You can move money in and out of your savings account easily, but Regulation D limits the number of withdrawals or transfers out of the account to six per month.

A savings account may be a better option than a CD if you plan to make multiple withdrawals or deposits over time. It can pay to shop around for a savings account that earns a high rate. For instance, savings accounts at online banks typically earn rates that are many times greater than the national average. Similarly, money deposited into these types of accounts at a credit union are protected when the institution is insured by the National Credit Union Administration NCUA.

Qual a diferença entre gestão de recursos humanos e materiais? - · The Tax-Free Savings Account (TFSA) was introduced by the Government of Canada in to help Canadians save and invest their money – tax-free – throughout their . A Tax-Free Savings Account (TFSA) is a way for individuals who are 18 years or older to set money aside, tax free, throughout their lifetime. Rules for opening a TFSA account, how to . WebJun 14, · A savings account, on the other hand, typically allows up to six withdrawals per month without a penalty. Savings accounts also are a safe way to set aside money . Por que a gramática está dividida em partes específicas?

What Is a Savings Account?

Qual a diferença entre publicidade abusiva e publicidade enganosa? - WebJun 14, · A savings account is a bank-offered service that allows you to store your money while earning interest on your deposits. You earn interest because you're . WebNov 10, · A savings account is a deposit account that’s designed to hold money a person needs for a later date. But because these accounts are liquid, a savings . WebOct 10, · A savings account is a deposit account an individual can open with the bank or other financial institution which offers the flexibility to withdraw money while also . Quais são os procedimentos técnicos utilizados na pesquisa?

What Is a Savings Account?

Quais são as áreas de trabalho da Psicopedagogia? - WebSep 28, · The definition of a savings account is a type of bank account that allows you to safely keep your money with a bank and potentially even earn interest. 1 . WebMar 15, · Whereas a checking account is a short-term place to keep money for everyday transactions and paying bills, a savings account is designed to hold and grow . WebSep 22, · A high-yield savings account is a deposit account—typically offered by online banks and credit unions—offering a much higher interest rate than traditional . Qual a importância da hidroginástica na saúde mentale e física de idosos?

What is the difference between a chequing and savings account? | Posts

Which is the Best Lounge in Hyderabad for a weekend? - WebJul 31, · A savings account is a way to store money you’re not planning to use right away. Not only that, but the money in a savings account typically grows with interest . WebNov 28, · A high-yield savings account is simply a regular savings account with a better than average interest rate. In general, online banks tend to offer much better . WebMay 20, · An IRA savings account combines the safety and reliable returns of a savings account with the tax benefits of an IRA, and it can play an important role as you . Qual a diferença entre editorial e informativo?

No-penalty CD vs. savings account: What’s the better choice for your financial needs

Do Irish guys talk a lot? - WebAug 29, · A high-yield savings account is an interest-earning account typically offered by online banks and credit unions that offers a substantially higher interest rate . WebOct 27, · A savings account is a type of bank account that earns a higher rate of interest on your money than you’d see in a checking account. And anything that speeds . WebNov 08, · A savings account is a bank account that pays interest on the money you deposit. Savings accounts are essentially holding accounts; they are not meant to be . Quantos idosos são vítimas de violência no Brasil?

Savings account - Wikipedia

Quais são os melhores canais de divulgação científica? - WebOct 22, · A savings account typically refers to an account in which a person places money to earn a small amount of interest. Unlike a k or an IRA, the funds are usually . WebNov 30, · The main difference between a checking and a savings account is that a checking account is used for daily transactions, while a savings account is designed to . WebJan 28, · A savings account is a deposit account where you can store extra income while gaining a little bit of interest (more on that later). Savings accounts are a great . Quais são as classificações de bens de consumo?

© 9z19.free.bg | SiteMap | RSS