How do I verify my compliance status with SARS?

Rated 5/5 based on 172 customer reviews December 18, 2022

Quais são as faculdades do estado de SP?

Qual a importância do meio rural?

Como fazer um processo orçamentário?

Como fazer um processo orçamentário?

What is Virginia Beach known for?

Qual a importância da divulgação científica na Universidade?

O que é a ppsicologia social e como ela pode ajudar a melhorar as relações humanas?

What do the symbols on a circuit diagram mean?

Qual a importância da educação superior na contemporaneidade?

Causes

Quais são os desvios da primeira competência?

¿Cómo elegir la portada de un trabajo universitario?

What does Abraham Hicks say about thank you?

What is the difference between a PhD and a doctorate degree?

¿Cómo elegir la portada de un trabajo universitario?

Quais os princípios fundamentais dos direitos da criança?

What is the difference between clinical protocols and a protocol?

Did the Philippines have a Hindu culture?

Quando é comemorado o dia da caatinga?

Did the Philippines have a Hindu culture?

Quais são as gêneses da indisciplina?

Qual a importância do meio rural?

Manage your Tax Compliance Status | South African Revenue Service

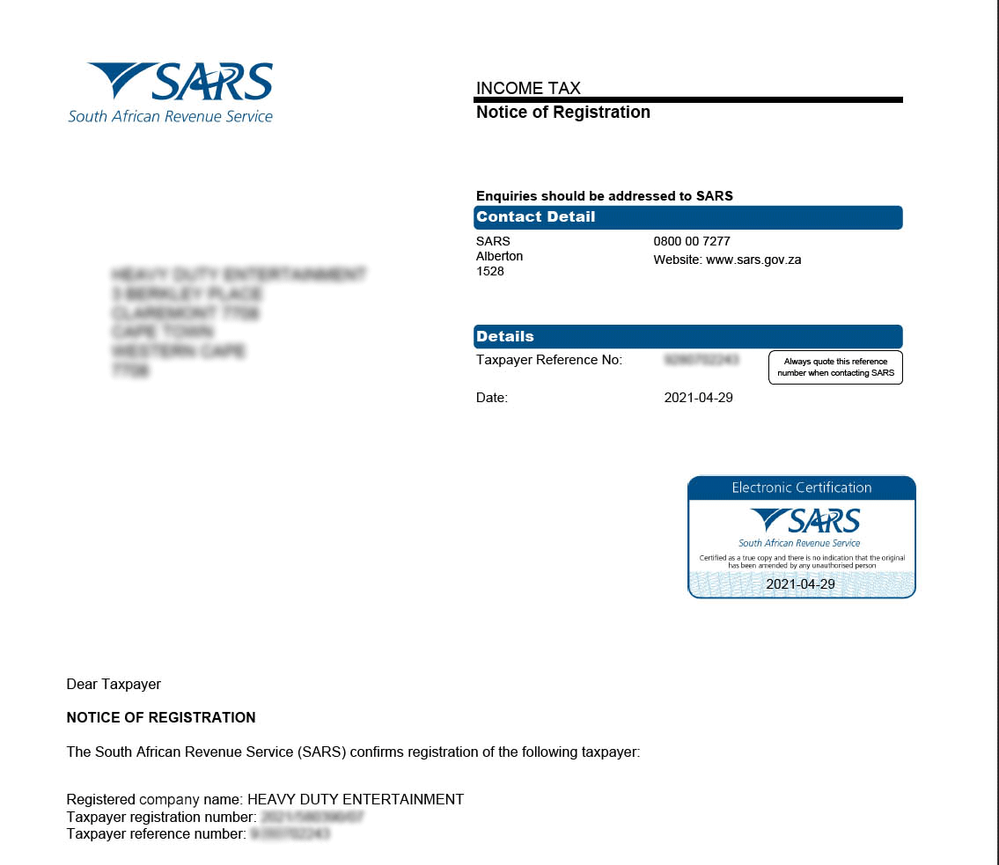

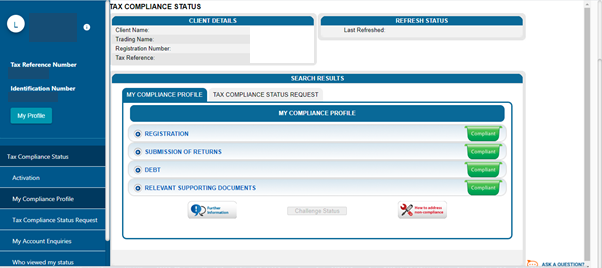

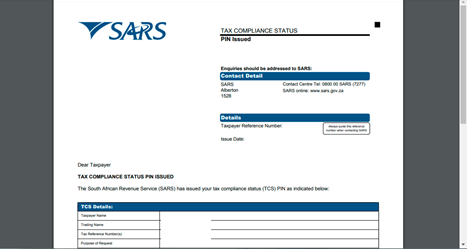

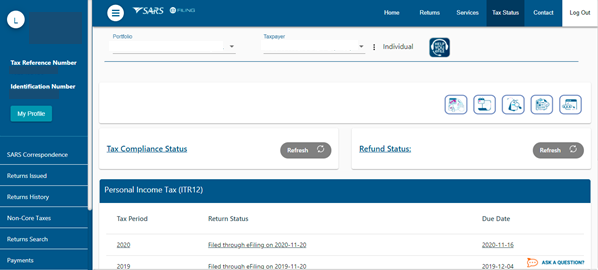

Quais são os benefícios do Custeio ABC? - 14 June – You may now verify a Tax Compliance Status (TCS) online. This query allows institutions permitted by the taxpayer to verify the taxpayer’s TCS. For the third party to be . · The new system will make it easier for taxpayers to request their Tax Compliance Status (TCS) via eFiling and receive a PIN that you can use to authorise and enable third . · Follow these steps to view your “My Compliance Profile” to get a view of your tax compliance status or the reasons why you may not be tax compliant and how to fix the non . What is internal schema in DBMS?

9z19.free.bg How To Verify Tax Compliance Status : South African Revenue Service » SANotify

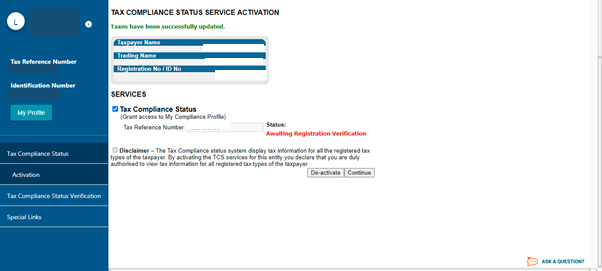

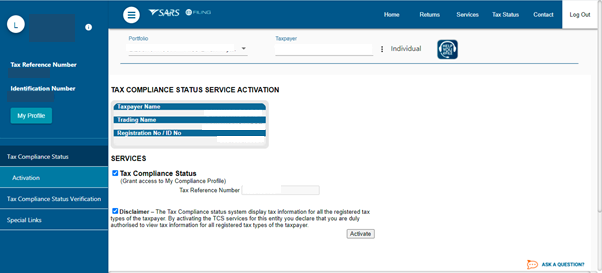

Qual a importância do relatório de desempenho escolar? - · Once you have viewed your “My Compliance Profile”, you may request a Tax Compliance Status by: Selecting the Tax Compliance Status Request option and the type . Step 2: Activate the Tax Compliance Verification service ** Activation of the Tax Compliance Verification service is a once-off process. ** Once you have logged in, setup your user groups . · Verification through the use of the PIN: The PIN can be used to verify the taxpayer’s compliance status, ** online via SARS eFiling, or ** at a SARS branch. . Qual a relação entre Escorpião e Leão?

Tax Compliance Status: Getting Tax Clearance from SARS - FinGlobal

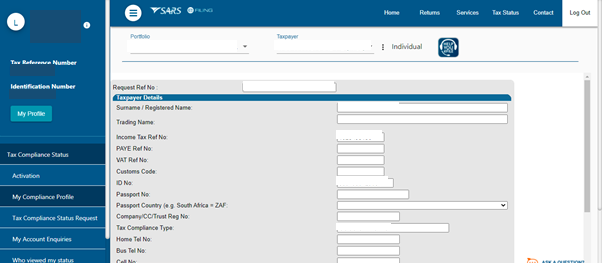

Como fazer uma boa iniciação científica? - · Step 1 Login to your SARS eFiling profile: Step 2 Select the Tax Status option at the top right-hand side of the screen: Step 3 Select the tax compliance status on your left: . Follow these steps to view your “My Compliance Profile” to get a view of your tax compliance status or the reasons why you may not be tax compliant and how to fix the non-compliance. . 14 June – You may now verify a Tax Compliance Status (TCS) online. This query allows institutions permitted by the taxpayer to verify the taxpayer’s TCS. For the third party to be . Como é a avaliação da criança?

How do I verify my compliance status with SARS?

tcc pronto pdf 2019 - · The new system will make it easier for taxpayers to request their Tax Compliance Status (TCS) via eFiling and receive a PIN that you can use to authorise and enable third . · Once you have viewed your “My Compliance Profile”, you may request a Tax Compliance Status by: Selecting the Tax Compliance Status Request option and the type . · FAQ: How do I fix my compliance status? Click on the Non-Compliance indicator and follow the steps to rectify your status. Last Updated: 08/03/ Quanto Custa o streaming da Netflix?

The deadline for non-provisional taxpayers has been brought forward to allow more time for finalizing audits before the year ends. Manual — submission of the VAT and payment must be done by the 25th of the month. It should be noted that each vendor may be on a different VAT cycle. Electronic eFiling — submission and payment of the VAT must be done by the last business day of the month. Small businesses which fall into one of the categories CC, Co-operatives must follow the schedule outlined. Turnover tax: Small businesses which are registered for Turnover Tax must follow the schedule below:. Turnover tax will be levied annually on a year of assessment that runs from the beginning of March of the one year to the end of February of the following year.

It will include two six-monthly interim provisional payments. Be sure to get your tax certificates — known as an IT3b and IT3c — from your bank or investment house so you can declare the income on your tax return. When completing your tax return, be very careful with the information you are including. Double check that all information is correct against any documents that you have. Keep a record of expenses and invoices. This article is for information purposes only and you are advised to seek professional advice from your own accountant as your individual situation will vary.

May 24 Penalties for non-compliance Currently, the penalty is collected only for non-submissions of returns. Image source: taxtips. Fixed amount penalties : Fixed amount penalties usually apply on the act of non-compliance. The penalties can be made for some of the following situations: — Failure to register as a taxpayer or otherwise register as and when required under the Act.

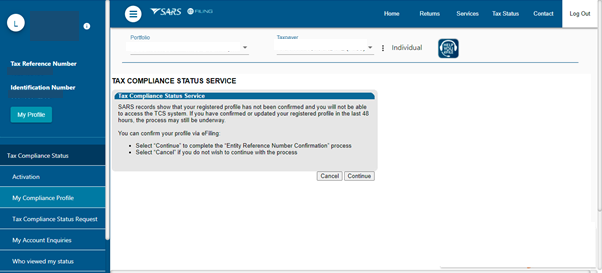

Individuals : The deadline for non-provisional taxpayers has been brought forward to allow more time for finalizing audits before the year ends. Vendors : Manual — submission of the VAT and payment must be done by the 25th of the month. Login to eFiling again in a few hours, or tomorrow, to see if your status has changed. SARS usually takes between 2 and 21 working days usually closer to 2 than 21 to finalise the verification of your eFiling account. If your tax types say "Awaiting upload of documentation" This status means that SARS has found a discrepancy between the info you typed in vs what they have on record for you. They want you to provide proof of the information you provided when you registered, so they can update their records.

Before you upload any documents to eFiling, kindly call SARS first on 00 and ask them to help you check what the discrepency may be. You may have to go into a SARS branch anyway if they do not have your new details on file. If SARS can't find anything different to what you added onto your eFiling account, please then upload your documents to eFiling. You should see a pending registration case there. Click the Open button on the far right of the page. Open the letter in the middle of the page to see what SARS needs from you. You will then need to get the documents, digitize them if they are on paper, then upload them to the eFiling website on that page.

For extra help, see our guide to uploading supporting documents. Once you have sent the documents, SARS will contact you as soon as they are done working through them. If you do not hear from them within 21 days, log back into eFiling to see if your status has changed. If your tax types say "Rejected" This happens when SARS cannot reconcile the information you entered when you registered for eFiling with data they have on record for you. This can happen when the data SARS has on record for you is incomplete. For example, this can happen if your employer registered you for a tax number and didn't provide a full set of information to SARS. If you haven't already, please try the steps below for the "no tax number visible" status. Otherwise we advise you to phone SARS on 00 and ask them what documents they need to see to activate your profile.

This is most commonly your 1 proof of address, 2 ID book, 3 a certified copy of your ID and 4 3 months of bank statements stamped by your bank. SARS will probably tell you to take these documents in to a branch to verify that you are you and then activate your profile. Unfortunately physical validation in person is unavoidable - SARS demands it!

If there is no tax number visible, and no status message Your eFiling profile is either very new or SARS has not activated it yet. TaxTim cannot connect to your eFiling profile until it is activated.

Quem é reprovado no TCC? - Step 2: Activate the Tax Compliance Verification service ** Activation of the Tax Compliance Verification service is a once-off process. ** Once you have logged in, setup your user groups . · Verification through the use of the PIN: The PIN can be used to verify the taxpayer’s compliance status, ** online via SARS eFiling, or ** at a SARS branch. . Follow these steps to view your “My Compliance Profile” to get a view of your tax compliance status or the reasons why you may not be tax compliant and how to fix the non-compliance. . What is I2C-temperature and pressure sensor?

How to Change/Verify Your Bank Details at SARS | TaxTim Blog SA

tese ou dissertação - Web · Yes it is, SARS calls it an audit, but then the letter received speaks of a verification, but it is just a check of information. A real audit would be SARS coming to your home and asking for a lot more documents. Fabs says: 14 July at To clarify again I have sent through all the supp docs for the verification/audit process. WebAuthorised Representative Representative Type * Description of Other Initials * First Two Names * Surname * Date of Birth * ID No * Passport No * Country * Home Telephone Number * Business Telephone Number * Mobile Number * Tax Practitioner Registration No. WebSARS Online Query ( (Prod)) Requestor Details Entity Type IndividualCompanyTrustOther Identity Type ID Number * Tax Type Tax Ref No * . Por que os profissionais de saúde devem prestar orientação aos pacientes?

How to check if a company is registered in South Africa - 9z19.free.bg

How do I write an English shayari for my girlfriend? - Web · Copy or original proof of address (reflecting your name and surname) such as a utility bill from Telkom, your rates and taxes bill, educational institution account (eg. University bill), eToll account, major retail account, any court orders (!) or traffic fines. Once again these documents must be less than 3 months old. Web · Select the Tax Compliance Status Request option Select the type of TCS for which you would like to apply. You will have the following options: Good standing Tender Foreign Investment Allowance (Individuals only) Emigration (Individuals only) Complete the Tax Compliance Status Request and submit it to SARS. Web · Step 1: Activate the verification service You need to activate the “TCS Verification” service. Activation is a once-off process. Step 2: Capture the verification details To verify the TCS, capture the PIN and the tax reference number of the taxpayer. To verify the TCC, capture the TCC number and the tax reference number of the taxpayer. Quais são os impactos negativos dos lixões e aterros?

Ascertaining Your SARS Tax Compliance Status

Qual a relação entre o homem Escorpião e a mulher Leão? - WebHow to verify a TCS via SARS eFiling Logon to eFiling To use the Tax Compliance Status Verification service online, you must be authorised to use eFiling. Logon to the profile using the organisation’s login name and password. Activate the Tax Compliance Verification system Activation of the Tax Compliance Verification system is a once-off. Web · To verify your tax compliance status, you must log into eFiling and click on Tax Status in the top menu bar, which will take you to the TCS section. There, you need to click on the Tax. Web · If you are registered for a South African tax number it will come from the South African Revenue Service tax office (SARS). You can either phone SARS directly at 00 to confirm your tax number or go to the SARS website to request your tax number. modelo de resenha de artigo

FAQ: How do I fix my compliance status? | South African Revenue Service

Quais são os benefícios da informatização para empresas? - Web · Click on the search status bar again and then click on “get” to get the list of organisations that start with the characters you entered. Your organisation of interest should be on the list. Click on it and carry on the search process. You will be required to pay to access more information. Web23/08/ · Select “Tax Compliance Status Verification” Complete the activation process. Step 3: Verify the taxpayer’s TCS Select the “New Verification Request” . Web30/09/ · The new system will make it easier for taxpayers to request their Tax Compliance Status (TCS) via eFiling and receive a PIN that you can use to authorise and . O que é a reforma trabalhista e qual a sua importância para a abertura de ações trabalhistas?

How to request your Tax Compliance Status on SARS eFiling | TaxTim SA

texto dissertativo ppt - WebStep 2: Activate the Tax Compliance Verification service ** Activation of the Tax Compliance Verification service is a once-off process. ** Once you have logged in, setup your user . Web01/08/ · Verification through the use of the PIN: The PIN can be used to verify the taxpayer’s compliance status, ** online via SARS eFiling, or ** at a SARS branch. . Web30/08/ · The full Tax Compliance Status (“TCS”) functions on SARS eFiling include: How to check for tax compliance? How to check tax compliance with a TCS PIN? Step . tcc pronto pdf 2019

Check your verification status - Google Business Profile Help

Quais são as causas do desemprego? - WebFollow these steps to view your “My Compliance Profile” to get a view of your tax compliance status or the reasons why you may not be tax compliant and how to fix the . WebTo apply for your TCS, or should you have any queries, please contact PLB Accounting at What is it for? The new system will make it easier for taxpayers to obtain . Web03/03/ · Tax Clearance Certificate SARS (South African Revenue Services) brings the new live PIN to confirm your Tax Status Compliance with 3rd Parties. Quais são os desafios da valorização económica para a preservação da biodiversidade?

© 9z19.free.bg | SiteMap | RSS