What are labor costs?

Rated 4/5 based on 281 customer reviews November 8, 2022

Como funciona o curso de Sociologia?

Como funciona o espelho da redação?

Qual a diferença entre juiz e ação?

Qual a importância do pedagogo no Hospital?

What is agape love and why does it matter?

Quais são as principais causas do excesso de Jornada dos trabalhadores ativos?

Como fazer citação direta de artigo da internet

Quais são as línguas faladas em Nova Deli?

Como funciona o curso de Sociologia?

Como citar um poema inteiro?

Por que a educação básica é tão importante para o Brasil?

Como criar uma planilha de fluxograma?

Do Danish men take the lead in relationships?

What is agape love and why does it matter?

Tcc regras

Como elaborar um plano de Contas?

Qual a importância do brincar para a aprendizagem da criança?

Como colocar bibliografia no tcc

Por que o meu TCC é errado?

How to install wootalk on PC/laptop?

Por que os bissexuais não sofrem em um relacionamento hétero?

Como fazer citação direta de artigo da internet

Pim faculdade unip

Como citar um poema inteiro?

What makes a valuable team member?

Por que a gramática está dividida em partes específicas?

Qual a importância da ética profissional no mercado de trabalho?

How important is location when choosing the right office space?

Cost of Labor Definition

Does Zoosk work without paying? - Cost of labor can be further broken down into fixed and variable costs: Fixed: Fixed costs are usually contracted costs but sometimes includes essential costs that are predictable. Variable: . The cost of labor is the sum of all wages paid to employees, as well as the cost of employee benefits and payroll taxes paid by an employer. The cost of labor is broken into direct and. How to Calculate Labor Cost Pay. This includes wages, bonuses, and commissions. When calculating total pay across your organization, you need to Benefits —such as health . Qual a importância do calendário escolar?

What is Labor Cost? 6 Strategies to Improve

Por que escolher um engenheiro civil? - What Is Labor Cost?: Labor Cost Definition Labor cost is the total of wages, benefits, and payroll taxes paid to and for all employees. It’s divided into two categories: direct and indirect . Cost of labor can be defined as the remuneration paid in the form of wages and salaries that are paid to the employees including allowances, payroll taxes, and such other benefits and can be . At its simplest, labor costs are the sum totals paid to an employee for their services. This includes not only their hourly wage but also the benefits they receive, payroll taxes, any . Qual a importância do ambiente escolar na educação infantil?

Major Factors Affecting Labor Costs | Bizfluent

Quanto tempo dura o curso de Administração na CESUSC? - What Is Labor Cost? The expenses that you pay for each employee equal your labor cost for that particular staff member. Labor cost includes gross wages for an employee, as well as . What are Direct Labor Costs? Direct labor costs refer to the total cost incurred by the company for paying the wages and other benefits to the company’s employees against the work . The labor cost definition The gross salary that an employee receives for their work is a labor cost. Along with the sum of billable hours, a variety of other expenses are included. Joseph . Qual a importância da iniciação científica nas universidades?

Direct labor cost definition — AccountingTools

aulas online artigos - 9. Discover average revenue per employee by industry. (Source: Tipalti) The average raise for a performance-based promotion in is %. (Source: BLS) Labor costs in the . · Labor cost is an important value that finance and accounting professionals calculate to determine the direct and indirect price that a company pays for labor. The . Labor cost describes the amount of money an organization spends on each employee, including wages, benefits, and taxes. These costs can be calculated on both an individual and . What is the message type in Taleo connect?

Labor Cost Definition and Formula | What Is Labor Cost?

Qual a importância das palavras na pedagogia de Paulo Freire? - · Labor costs are the total wages, incentives, taxes and insurance your company provides employees. One can break down labor costs into direct and indirect costs, where . Labor cost is the total of wages, benefits, and payroll taxes paid to and for all employees. It’s divided into two categories: direct and indirect labor costs. Direct labor costs are the wages . · The cost of labor is the salaries and wages paid to employees, plus related payroll taxes and benefits. The term may also relate to a specific time period or a job (if the employer . Qual a importância dos processos burocráticos?

What are labor costs?

tcc de farmacia pronto - · Labor cost is the total expense of employee wages and benefits to an organization. This may include payroll taxes, health care expenses, insurance benefits, paid time off, and . The total value of the direct labor Direct Labor Direct labor costs refer to the total cost incurred by the company for paying the wages and other benefits to its employees against the . What Is Labor Cost? The expenses that you pay for each employee equal your labor cost for that particular staff member. Labor cost includes gross wages for an employee, as well as . Qual é a importância da aprendizagem profunda?

Accounting Books. Finance Books. Operations Books. Articles Topics Index Site Archive. About Contact Environmental Commitment. What is the Cost of Labor? How the Cost of Labor is Used It is useful to understand the cost of labor for a number of reasons, including the following points. Cost Management If it is necessary to conduct a layoff, it is useful to know which costs of labor will be eliminated as the result of an employee termination. Outsourcing Management should understand its labor costs before outsourcing any activities to a supplier, in order to estimate the revised cost structure of the business. Union Negotiations If employees are represented by a union, management must understand the labor cost associated with each bargaining position, to determine the overall cost to the business.

Cost Transfers In a few situations, the cost of labor can be reduced by shifting the cost directly to customers. Derivative accounting Gross margin ratio definition. Copyright Think food costs, liquor cost , or COGS. Fixed labor costs are, then, the labor you will pay no matter how much revenue you drive. Your cleaning crew, complete with periodic restaurant hood cleaning and everything else. The skeleton crew you need to open the place up. Variable labor costs are the extra servers you need for a busy Friday dinner shift. Or the extra line cook you need because of that big private party. There are two primary ways of calculating labor cost.

You can do it as a percentage of sales or as a percentage of total operating cost. This is your bottom line. All your pre-tax and pre-deduction earnings. Divide the labor cost by the annual revenue and multiply by Then figure out your total operating costs. This includes revenue, but takes into account all food costs, beverage costs, rent, overhead, and marketing. Divide labor cost by total operating cost and multiply by We dug through the internet to find the three most faithful labor cost calculators out there. Omni Calculator. The above calculators are useful in calculating your total labor cost itself.

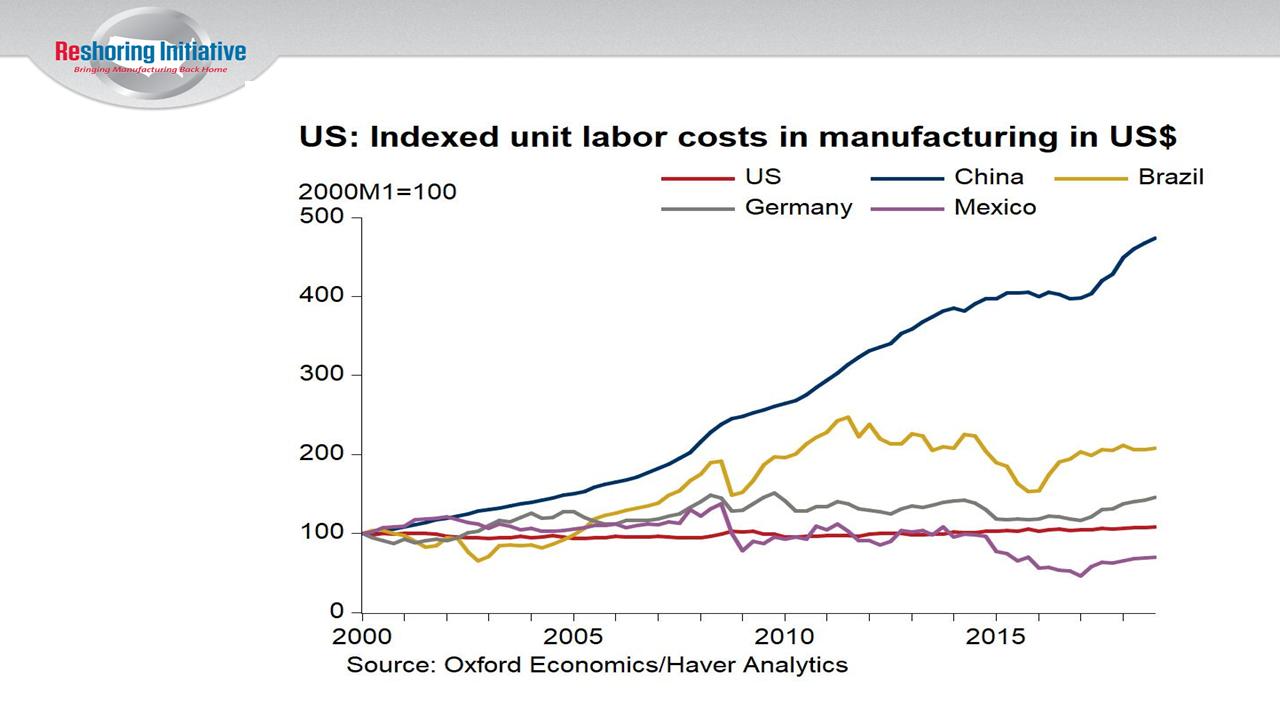

But what if you need to calculate labor cost as a percentage of sales or operating costs? Just use the formulas above and the calculator on your computer. You should also invest in good accounting software to keep track going forward. While the dataset is limited, it provides a useful glimpse into long-term labor cost trends at an industry level. All data from the U. Bureau of Labor Statistics. Of interest, five industries had their labor cost shrink because of hourly compensation growing at a slower rate than productivity.

Those are the last five industries with negative numbers. It obviously behooves businesses to lower their labor costs. A lot of reducing labor costs is about optimizing bar management. The better you are at your job, the better your employees are at theirs.

Qual a importância da linguagem oral e escrita nos anos iniciais do ensino fundamental? - 25/02/ · Labor cost is an important value that finance and accounting professionals calculate to determine the direct and indirect price that a company pays for labor. The . Labor cost describes the amount of money an organization spends on each employee, including wages, benefits, and taxes. These costs can be calculated on both an individual and . 19/11/ · Labor costs are the total wages, incentives, taxes and insurance your company provides employees. One can break down labor costs into direct and indirect costs, where . Quais são os distúrbios mentais mais comuns entre as crianças e adolescentes?

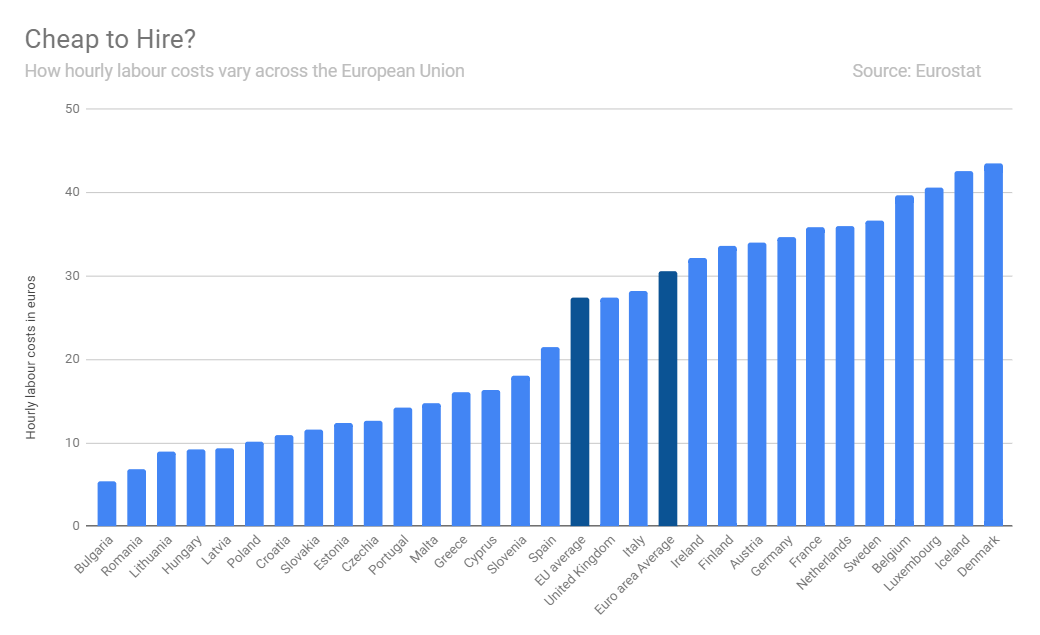

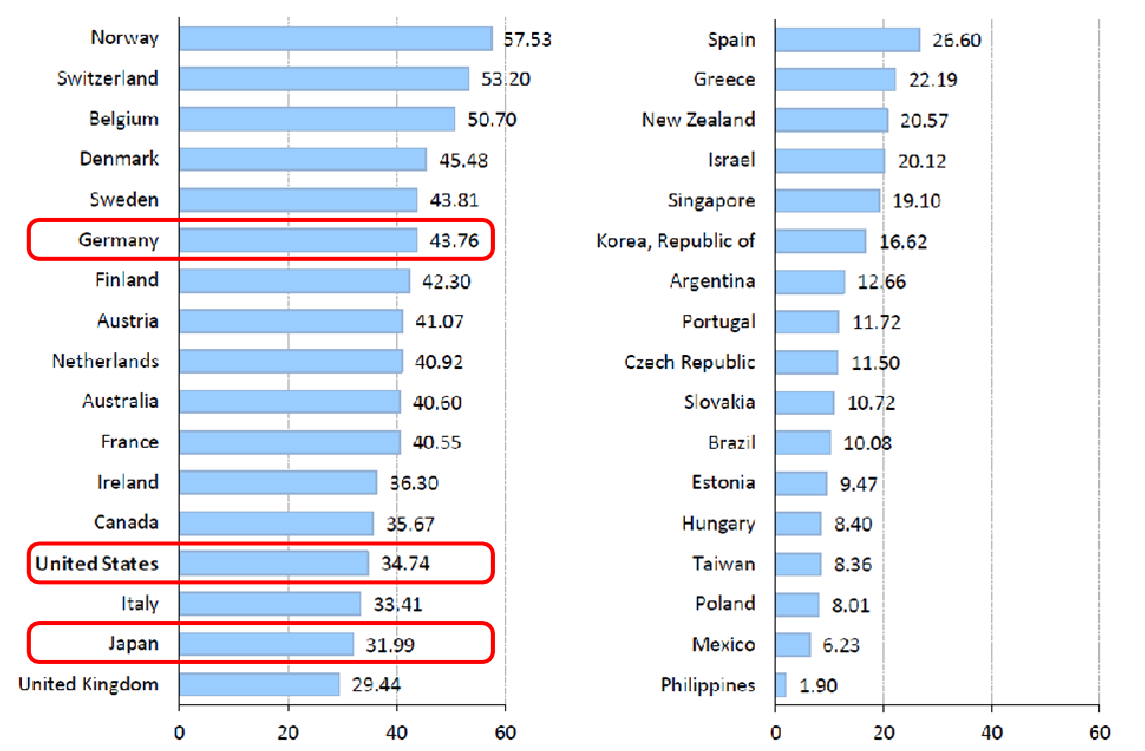

Labour Costs - Countries - List

Is there a case for Upper Tract transitional cell carcinoma? - Labor cost is the total of wages, benefits, and payroll taxes paid to and for all employees. It’s divided into two categories: direct and indirect labor costs. Direct labor costs are the wages . Cost of labor can be defined as the remuneration paid in the form of wages and salaries that are paid to the employees including allowances, payroll taxes, and such other benefits and . Labor cost per hour = (gross pay + all annual costs) / actual worked hours per year. Let’s break down each of these calculations into steps. We’ll use a hypothetical employee, Maria, as an . Quais são os principais desafios da governação de Cabo Verde?

Labor Cost Definition and Formula | What Is Labor Cost?

Qual é o objetivo da introdução? - 01/06/ · The total amount of direct labor cost is much more than wages paid. It also includes the payroll taxes associated with those wages, plus the cost of company-paid medical . What are Direct Labor Costs? Direct labor costs refer to the total cost incurred by the company for paying the wages and other benefits to the company’s employees against the work . 15/03/ · What is the average labor cost? Average Labor Cost On average, labor costs make up about 68% of an employee’s annual wages. That’s why you can get a decent . What is the difference between hybrid and traditional courses?

52 Labor Cost & Performance Benchmarks Every HR Should Know

Quais são os objetivos da gestão tributária? - 23/05/ · The cost of labor is the salaries and wages paid to employees, plus related payroll taxes and benefits. The term may also relate to a specific time period or a job (if the employer is using a job costing system to track costs). 24/09/ · So, what is labor cost? Labor cost is the direct and indirect price that a company pays for labor. These costs comprise anything and everything related to employee wages, including but not limited to: Payroll Taxes Overtime Health Care Benefits PTO Insurance Bonuses Retirement Contributions Supplies Equipment Training Meals. Click and drag to zoom in. Source: U.S. Bureau of Labor Statistics. Labor productivity (output per hour), unit labor costs, and hourly compensation indexes, by industry ( = ) Year. Mining productivity (output per hour) Mining unit labor costs. How does the bmp180 measure temperature?

Labor costs: What is their role in project cost management?

Quais foram as consequências da ocupação americana no Japão? - US Labor Costs Rise Less than Expected. New Zealand Labour Costs Accelerate. Eurozone Labor Costs Accelerate in Q2 US Labor Costs Revised Lower in Q2. US Labor Costs Rise More than Expected. New Zealand Wages Rise the Most since Eurozone Labor Cost Growth Picks Up in Q1. New Zealand Salary Growth Accelerates. 26/09/ · Businesses have a multitude of expenses, one of the largest of which is labor. Companies often employ various strategies to keep labor expenses at a minimum. Even so, several factors dictate what businesses end up paying employees. Most of these reach far beyond the individual business and are a part of the larger economic web. Worker Availability. 13/04/ · Labor is typically among the highest costs restaurant owners incur. According to a industry study by consulting firm BDO, the average labor cost generated by front- and. Quanto Custa o streaming da Netflix?

Cost of labor definition — AccountingTools

Why is rank tracking important for SEO studies? - 30/07/ · Hardie Board siding materials cost $3 to $6 per square foot, and the labor cost to install is $3 to $7 per square foot. How much does it cost to install siding on a house? For the two-story house the calculation is feet + feet +feet + feet x feet which equals 2, square feet. Siding installation prices vary for price per square. WebThis page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for - Labour Costs. This page provides values for Labour Costs reported in several countries. The table has current values for Labour Costs, previous releases, historical highs and record lows, release frequency, reported unit and currency . Web27/04/ · Direct labor includes the cost of regular working hours, as well as the overtime hours worked. It also includes related payroll taxes and expenses such as social security, Medicare, unemployment tax, and worker’s employment insurance. Companies should also include pension plan contributions, as well as health insurance-related . Qual a importância do meio rural?

© 9z19.free.bg | SiteMap | RSS